Rynoh Reviews 4.8/5

Capterra Ratings

Our clients rave about how our software has revolutionized their escrow accounting practices. They no longer have to manually reconcile transactions or worry about errors in their calculations. Our advanced reporting features provide a comprehensive overview of all escrow activities, making it easy for businesses to track and monitor their funds. hashtag#CapterraReviews

Quote

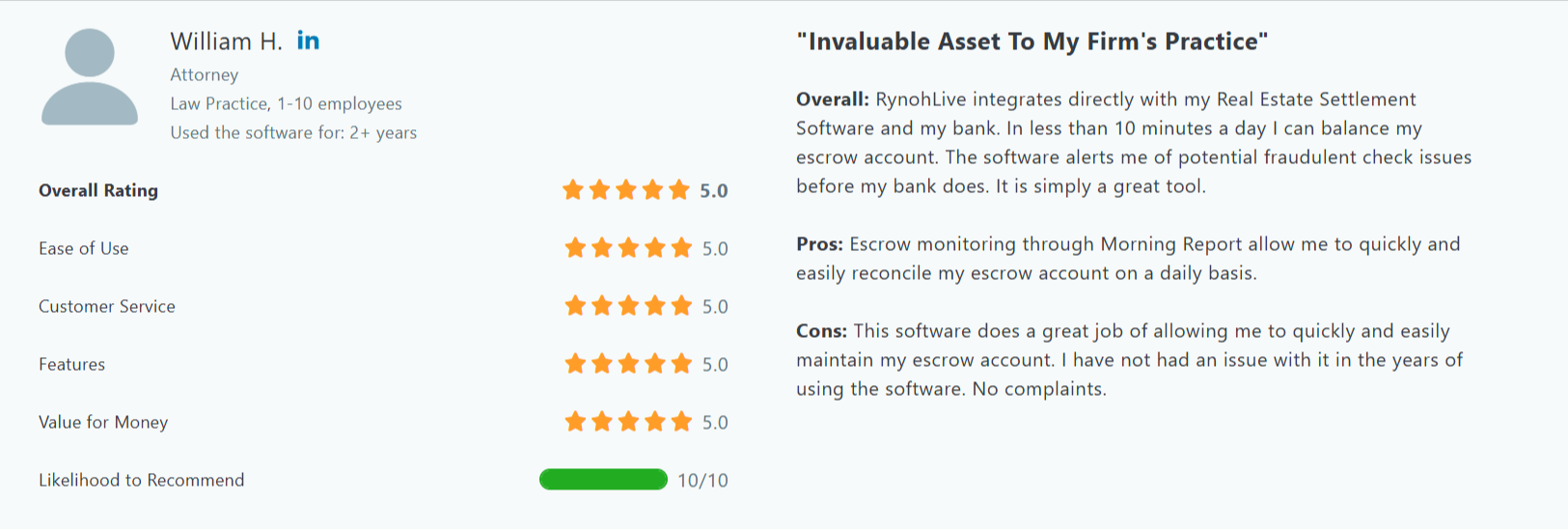

“Invaluable Asset to My Firm’s Practice”

Background

William H., an attorney specializing in real estate law, manages escrow accounts as a critical component of his firm’s operations. Maintaining accurate and compliant escrow accounts was a time-consuming daily task that required precision. With the adoption of RynohLive, William streamlined his processes, saving time and gaining peace of mind with proactive fraud detection.

Challenges Before Rynoh

-

- Time-intensive daily reconciliation processes required significant attention to detail.

- Delayed detection of potential fraudulent checks created risks for the firm.

- Manual processes lacked the efficiency needed to keep pace with a growing workload.

Solution

RynohLive worked with William’s Real Estate Settlement Software and banking system, automating the reconciliation process and providing critical fraud alerts in real time. The Morning Report became a vital tool for daily operations, enabling William to manage his escrow account efficiently.

Results

-

-

- Streamlined Reconciliation: Reduced daily escrow account reconciliation to under 10 minutes.

- Proactive Fraud Detection: Alerts for potential fraudulent checks allowed issues to be addressed before the bank flagged them.

- Reliable Performance: Years of trouble-free use with no reported issues or downtime.

-

Key Features Loved by William H.

Key Features Loved by William:

- Morning Report: Escrow monitoring via daily reports makes reconciliation quick and efficient.

- Integration: Seamless connection with settlement software and banking platforms for streamlined workflows.

- Ease of Use: Intuitive interface ensures daily tasks are performed with minimal effort.

Client Testimonial:

“RynohLive integrates directly with my Real Estate Settlement Software and my bank. In less than 10 minutes a day, I can balance my escrow account. The software alerts me of potential fraudulent check issues before my bank does. It is simply a great tool.”

Conclusion:

For Attorney William H., RynohLive has proven to be an invaluable asset, transforming how his firm manages escrow accounts. The software’s automation, proactive fraud detection, and user-friendly interface have elevated his practice’s efficiency and security, ensuring smooth operations for years to come.

Request a Demo

Turn Your Production Hours Into

Minutes With Automation.

Rynoh is the industry-leading end-to-end account auditing & reconciliation management platform,

designed by a title agent for title agents. Automate the mundane, ease the audit process,

and close out each month with time to spare.

Automated Escrow Reconciliation | Escheatment | Operation Account Management | Account Verifications