RynohOpX

Operations Account Management

Rynoh OpX enhances operational efficiency by seamlessly integrating with your existing accounting software. Whether you’re using QuickBooks or Microsoft Dynamics Great Plains (GP), Rynoh OpX ensures compatibility for smooth, automated financial management.

Key Features

Automated Daily Reconciliation Eliminate manual errors and save time by automatically reconciling all accounts every day, ensuring your financial records are always accurate and up-to-date.

Convenient & Smart Reporting Generate comprehensive, easy-to-read reports on demand. Our intelligent reporting system gives you actionable insights into your finances without any extra effort.

Fraudulent Activity Identification Protect your business with advanced algorithms that detect suspicious transactions in real-time, helping you prevent fraud before it impacts your operations.

Seamless Accounting Integration Connect effortlessly with your existing accounting software, allowing smooth data flow, reduced manual entry, and complete financial transparency across platforms.

Product Summary

Rynoh OpX provides a comprehensive, end-to-end financial management solution for title agents and escrow professionals. Our platform delivers continuous account auditing, daily reconciliation, and real-time transaction monitoring, ensuring accuracy and compliance at every step. Advanced anti-fraud algorithms safeguard your operations, while built-in automated reporting streamlines financial oversight and decision-making.

With Rynoh OpX, your agency gains complete visibility, enhanced security, and operational efficiency, all in a single, intelligent platform that include:

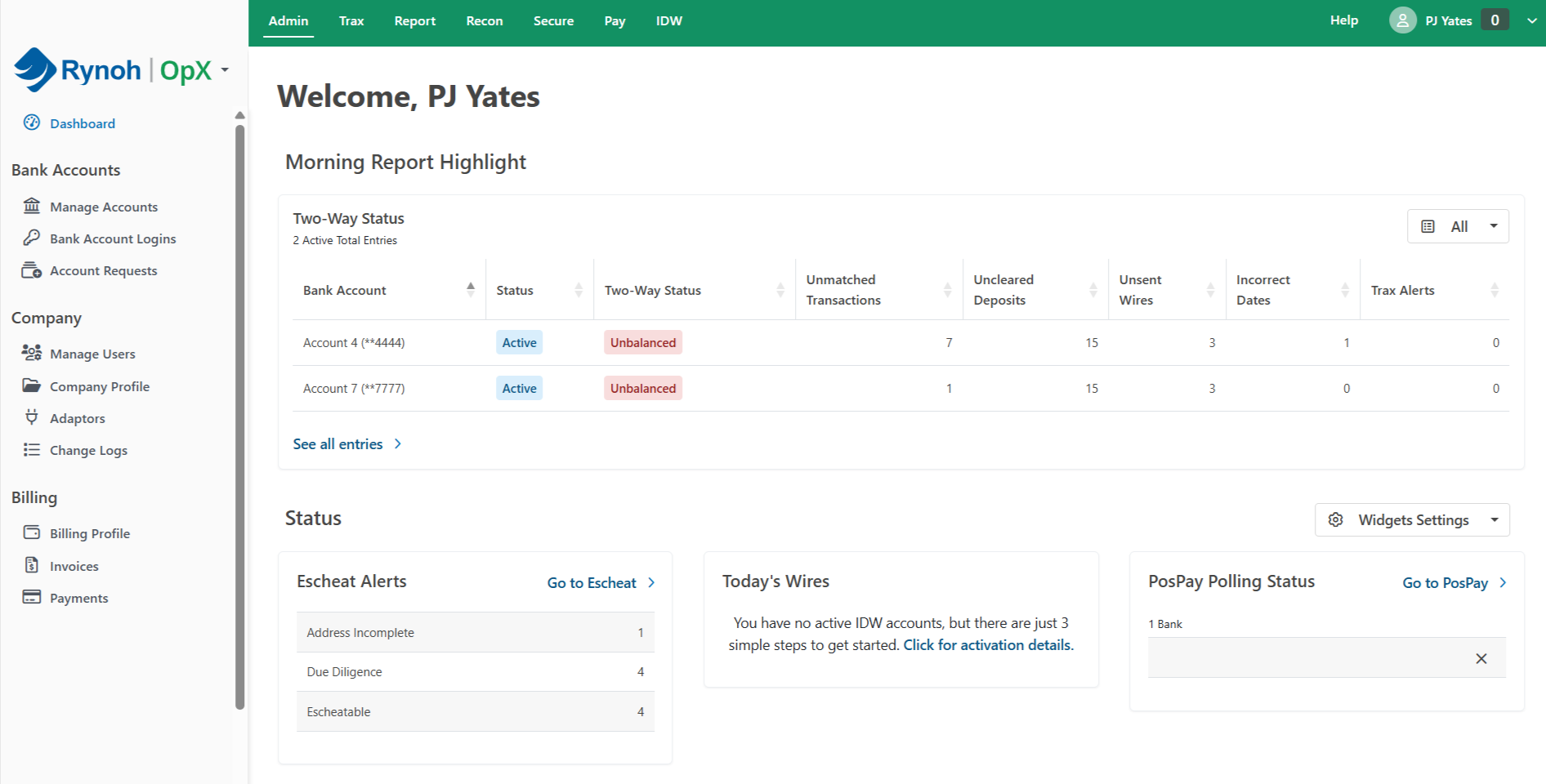

- Dashboard

Insights, alerts, and analytics, including:

- Three-way status

- Today’s wires

- File count tracking

- Escheat alerts

- Adapter polling status

- Updates & improvements

- Admin

Efficiently manage operational controls, including:

- Bank accounts and login credentials

- User permissions and change logs

- Billing, profiles, and invoice management

- Tracking

Stay on top of every transaction with:

- Real-time monitoring of disbursements and receipts

- Alert customization and exception tracking

- Daily reporting with customizable formats and search options

- Report

Comprehensive reporting and reconciliation covering daily operations, periodic tasks, and enterprise-level financial oversight:

- Daily reconciliation, transactions, balances, and standard reports

- Monthly submissions, archives, and one-time packages

- Bank statements, checks, debit files, and enterprise reports

- Reconciliation

Ensure accurate and compliant record-keeping with:

- Automated daily three-way reconciliation

- Detailed reports including cleared, outstanding, and book-only transactions

- Monthly recon submissions and audit-ready archives

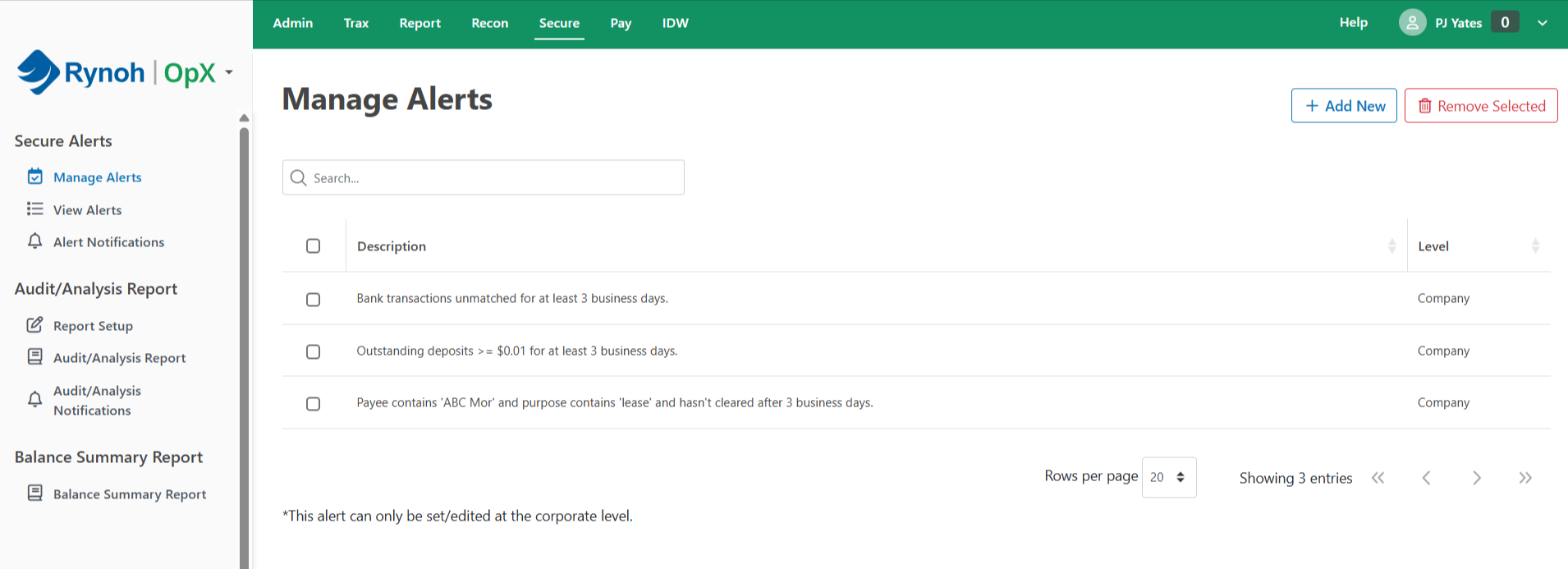

6. Secure Alerts

Proactively mitigate risk through:

- Real-time secure alert notifications for suspicious activity

- Custom thresholds and reporting for anomalies

- Audit and analysis tools to support internal review processes

- Positive Pay

Prevent check fraud with:

- Automated positive pay integration

- Seamless coordination with financial institutions

- Verification of disbursement legitimacy before clearing

- Intraday Wire

Maintain visibility and control with:

- Intraday wire tracking capabilities

- Timely updates on high-value transactions

- Integration with banking partners for enhanced transparency

Dashboard Snapshots

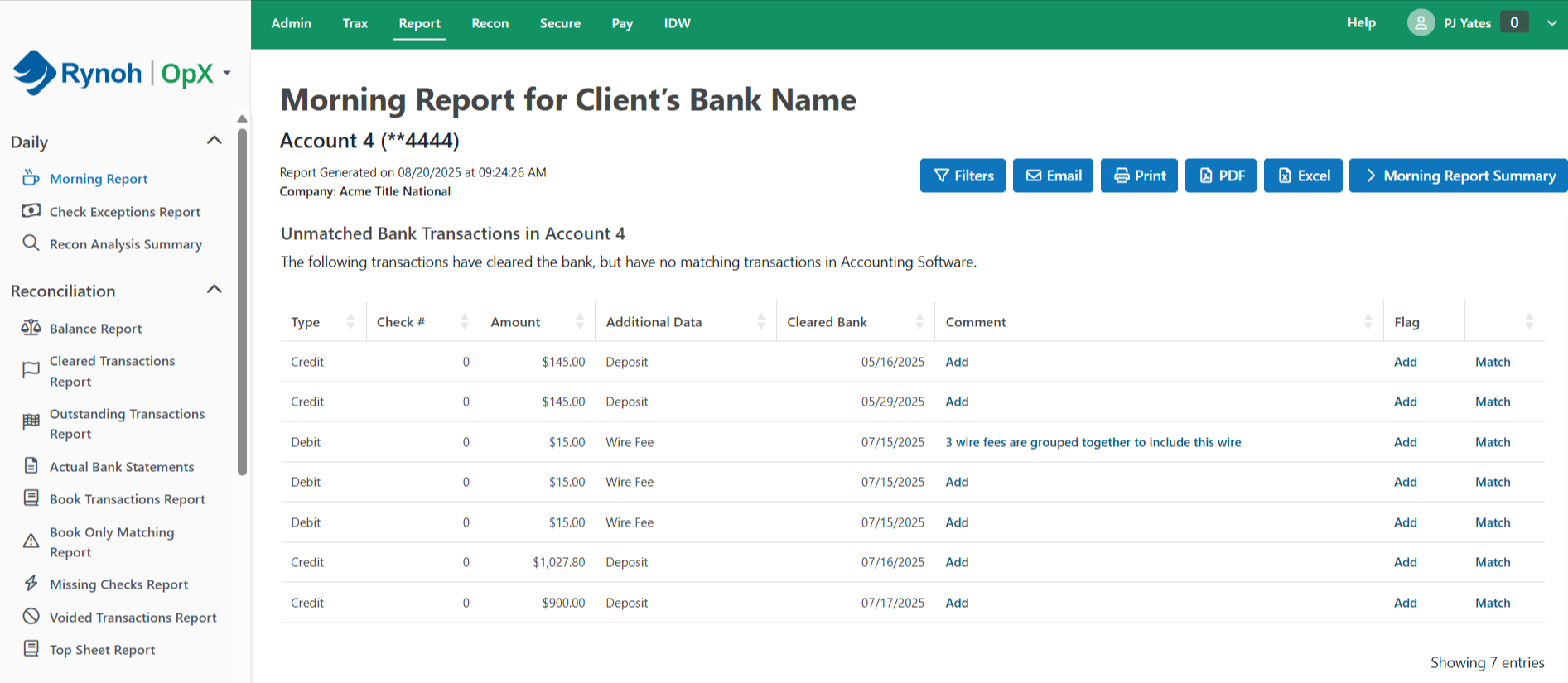

Reporting Dashboard

Daily Highlights

Manage Alerts

Client R&D Resources

Client Feedback

- Name: Michelle T.

- Title: Auditor

- Usage: Used the software for: 2+ years

- Quote: “Use of Rynoh is Best Practices”

Title Insurance agency owners, managers, and underwriter auditors find Rynoh an effective tool for monitoring the company’s activity and protecting the company from losses. As a title insurance underwriter auditor, I can tell if an agent is finding and remediating issues such as uncleared deposits and negative files in a timely manner. I can also tell if the closers or processors are sending out the payoffs quickly. In addition to the health and caretaking of the fiduciary accounts, I can also see if the agent is performing other Best Practices such as recording documents quickly and remitting to the underwriter within timeframes. Manager and owners can perform the same reviews that I do in order to mitigate losses increase productivity as well as effectively monitor operations.

Stop Rolling The Dice With Manual Processes & Escrow Accounting Pitfalls

Request a Product Demo & Get a Step-by-Step Walk-Through of Our Software

See How Your Business Can Benefit From Rynoh’s Immediate ROI Impact

Product Specs

Admin

- Dashboard

- Morning Report Highlight

- Two-Way Status

- Escheat Alerts

- Today’s Wires

- Positive Pay Polling Status

- Updates & Improvements

- Bank Accounts

- Manage Accounts

- Bank Account Logins

- Account Requests

- Company

- Manage Users

- Company Profile

- Adaptors

- Change Logs

- Billing

- Billing Profile

- Invoices

- Payments

Tracking

- Tracking

- Manage Alerts

- View Alerts

- Report

- Daily

- Morning Report

- Check Exceptions Report

- Recon Analysis Summary

- Reconciliation

- Balance Report

- Cleared Transactions Report

- Outstanding Transactions Report

- Actual Bank Statements

- Book Transactions Report

- Book Only Matching Report

- Missing Checks Report

- Voided Transactions Report

- Top Sheet Report

- Recon Submissions

- Monthly Recon Submissions

- Monthly Recon Archives

- One-Time Package

- One Time Package Log

- Report Setup

- Report Notifications

- Other

- Bank Statement Report

- Enterprise Reports

- High Liability Outstanding Checks

- Outstanding Checks

- Book Balances

- Bank Balances

- Check Register Report

- Debit Files Report

- Debit File History

- Trial Balance/Open Files

Secure

- Secure Alerts

- Manage Alerts

- View Alerts

- Alert Notifications

- Audit/Analysis Report

- Report Setup

- Audit/Analysis Report

- Audit/Analysis Notifications

- Balance Summary Report

- Balance Summary Report

Pay

- Positive Pay

- Transactions

- File Submission

Intraday Wire

- Intraday Wire

- Manage Accounts

- Manage Subscribers

- Transactions

Tracking

- Manage Alerts

- View Alerts