Rynoh Software Upgrade 4.0: Built For What’s Next

Get Started with a Demo — Discover What’s New

Welcome to Rynoh 4.0

At Rynoh, our mission is simple: to make financial management more secure, efficient, and effortless for our clients. With Version 4.0 of the Rynoh platform, we’re taking a bold step forward—introducing smarter automation, stronger compliance tools, and advanced security features that set a new standard for the industry.

Our Software Upgrade Series is designed to keep you informed and empowered. With every release, you’ll gain clear insights into new features, performance improvements, and training resources—so you can unlock the full value of Rynoh without disruption.

These upgrades aren’t just about keeping pace with change. They’re about staying ahead of it. From streamlined payment verification and automated disbursements to enhanced compliance and full-service escheatment, Rynoh 4.0 gives you the tools to navigate complexity with confidence.

With Rynoh, progress isn’t something you have to adapt to—it’s something you can rely on.

— Jim Weld, General Manager, Rynoh

October 1, 2025 Edition

💻Table of Contents

- Overview

- RynohFunding – Payment Verification With Automated Disbursements

- FinCen Compliance Reporting

- Login Screen Callouts

- RynohEscheat Enhancements

- RynohEsheat Professional Services

- Software Upgrade V3.1 – Rewind & Refresh

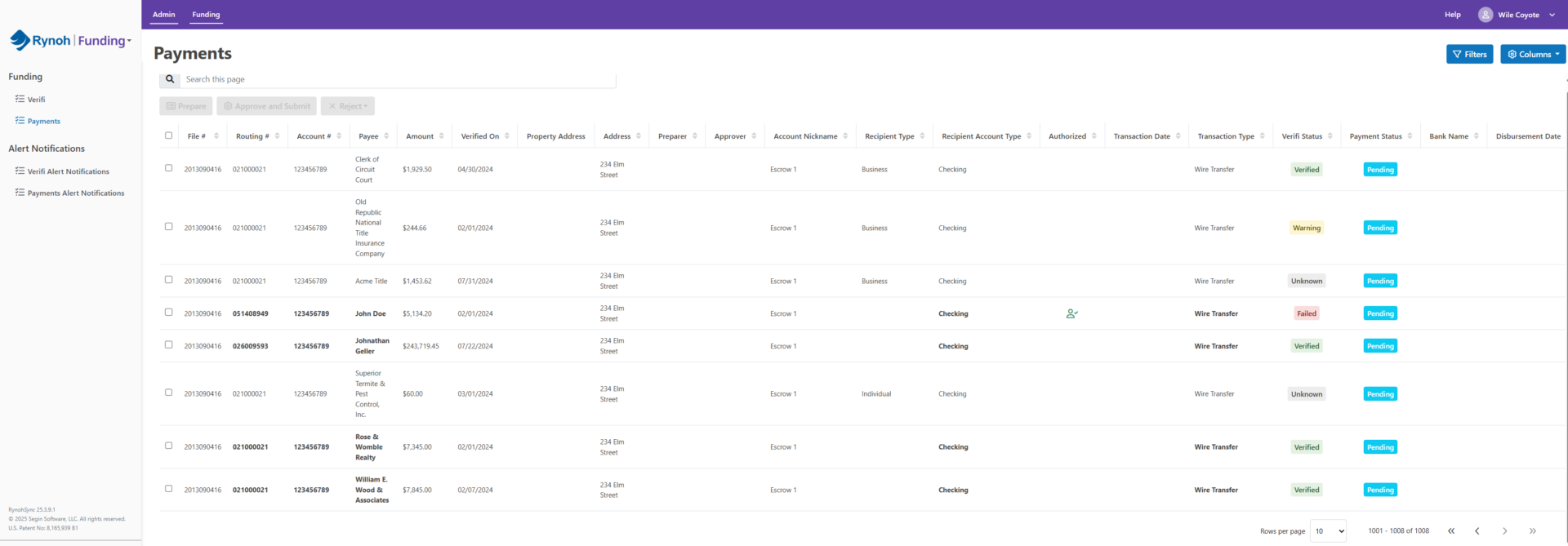

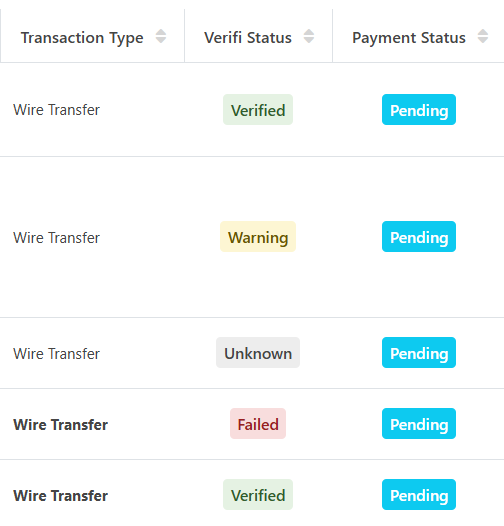

Rynoh Funding – Payment Verification with Automated Disbursements

Launch Date: October 2025

Product Overview

RynohFunding now combines intelligent payment verification with automated disbursement capabilities, streamlining financial transactions from start to finish. This upgrade ensures every payment is accurate, secure, and efficient—while reducing manual effort, time, and cost. Clients gain enhanced confidence in every transaction through automation and built-in protection.

Key Benefits

- Expanded Bank Integrations: Automated disbursements are available for clients banking with PNC, BankUnited, Wells Fargo, U.S. Bank, and Bank of America.

-

Efficiency & Security: Faster processing, reduced manual intervention, and stronger safeguards against error and fraud.

How to Access

This feature is available through the following banks: PNC, BankUnited, Wells Fargo, U.S. Bank, and Bank of America.

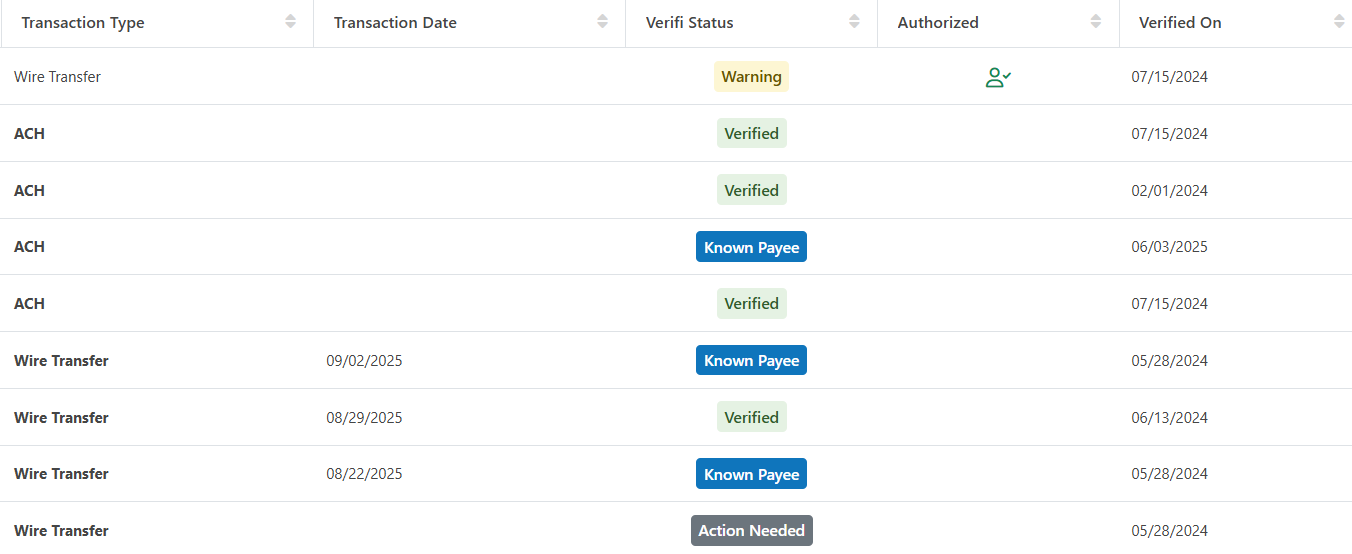

RynohVerifi Now Backed by $2M Fraud Coverage

Launch Date: November 2025

Product Overview

RynohVerifi has been enhanced to include a standard $2 million wire fraud guarantee, giving clients even greater peace of mind when disbursing payments. This guarantee reinforces Rynoh’s commitment to protecting transactions against fraud while ensuring accuracy, security, and trust in every payment.

Key Benefits

-

$2 Million Protection: Added financial assurance against wire fraud.

-

Increased Confidence: Strengthens trust in every transaction.

-

Risk Reduction: Minimizes exposure to costly fraud attempts.

-

Seamless Integration: Automatically included as part of RynohVerifi without extra setup.

How to Access

The $2 million wire fraud guarantee is automatically included in RynohVerifi.

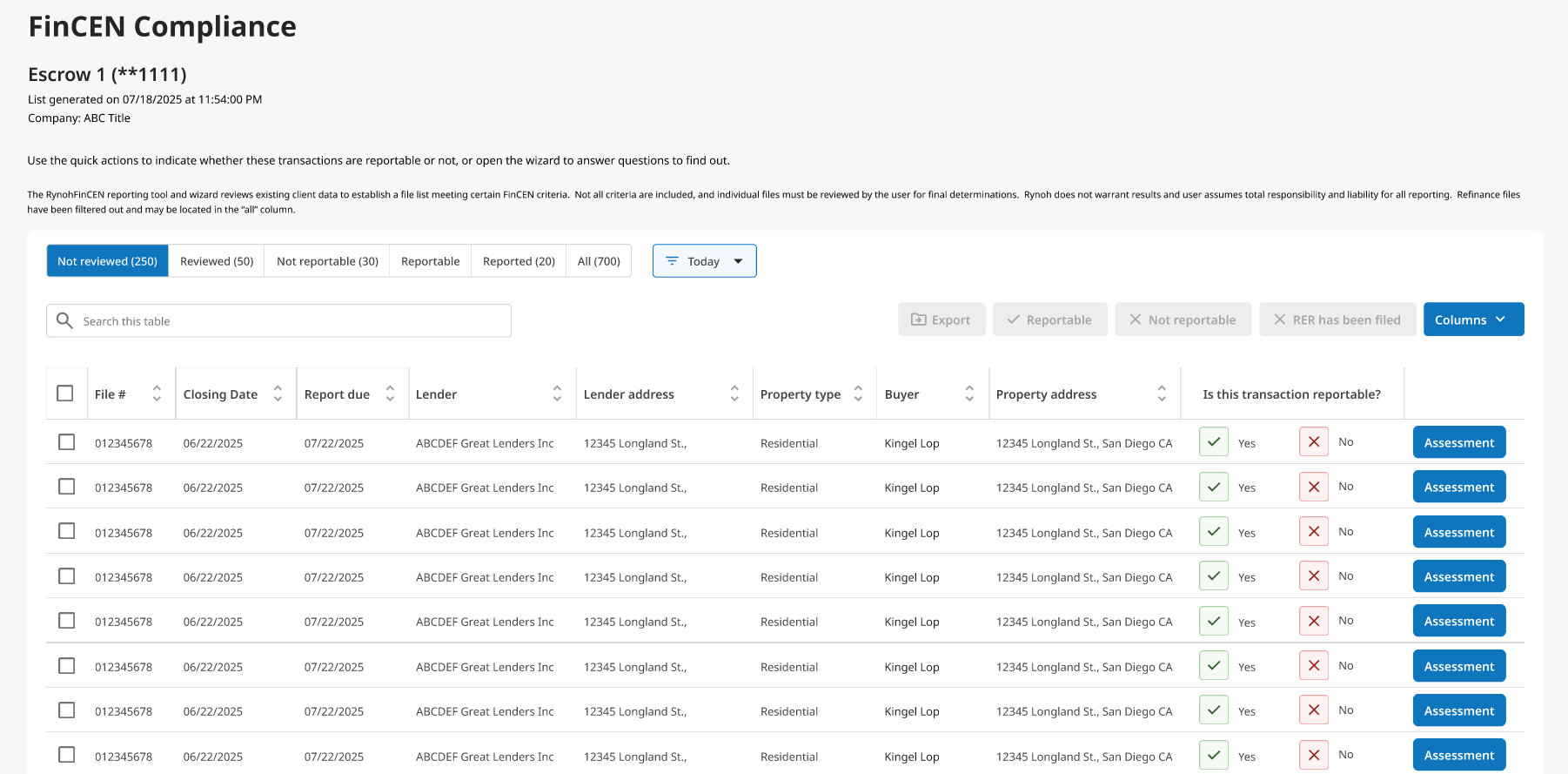

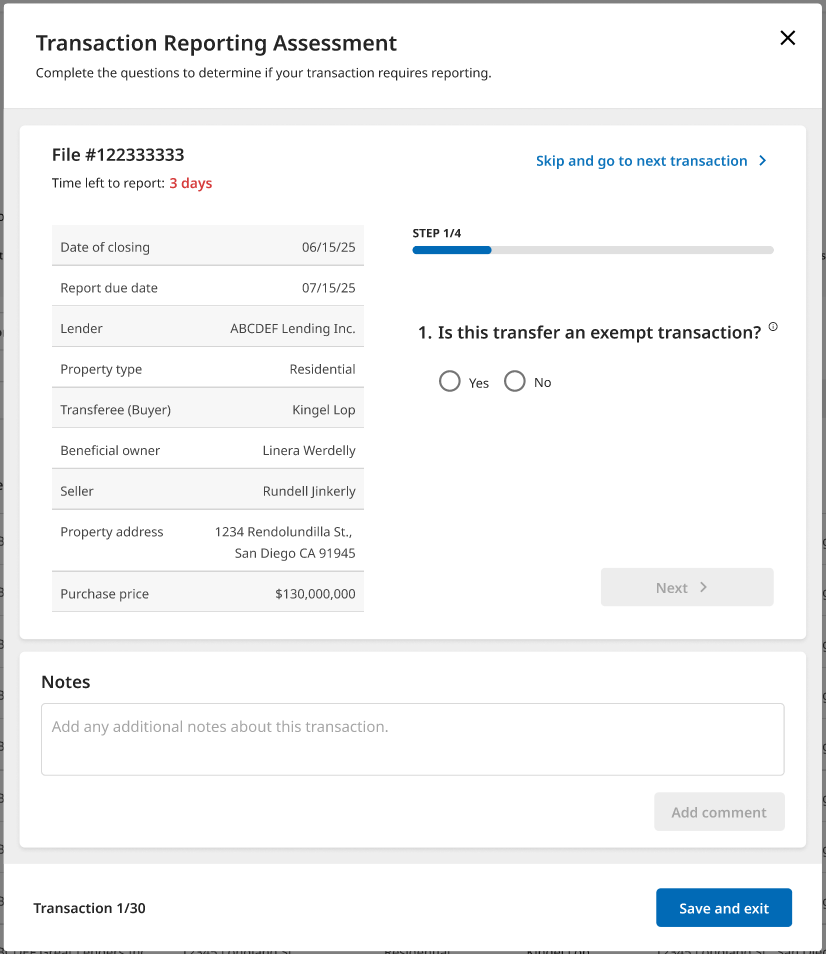

FinCEN Compliance Reporting

Launch Date: November 2025

Product Overview

Beginning December 1, 2025, new FinCEN (Financial Crimes Enforcement Network) reporting requirements will take effect, requiring institutions to file detailed reports on certain financial transactions. To ensure you’re fully prepared, Rynoh is introducing a dedicated FinCEN Compliance Reporting module—a streamlined solution that simplifies monitoring, reporting, and filing obligations.

This new product is designed to remove the uncertainty and manual effort associated with regulatory compliance. By automating the identification of reportable transactions and generating the necessary forms, Rynoh helps your business stay compliant while reducing administrative burden and risk of error.

Key Benefits

-

Proactive Compliance: Stay ahead of federal reporting requirements with built-in tools designed to identify and flag transactions that meet FinCEN thresholds.

-

Automated Form Creation: Save time by automatically generating the forms needed for filing, ensuring accuracy and consistency.

-

Risk Reduction: Minimize exposure to compliance penalties by removing manual guesswork and automating key processes.

-

Future-Ready: As regulations evolve, the module will continue to expand with new features and updates to keep your business compliant without added effort.

How to Access

The FinCEN Compliance Reporting module will be available directly in Rynoh Live software suite under the new FinCEN Reporting tab. Clients will receive notifications and guidance ahead of launch to ensure a smooth adoption process.

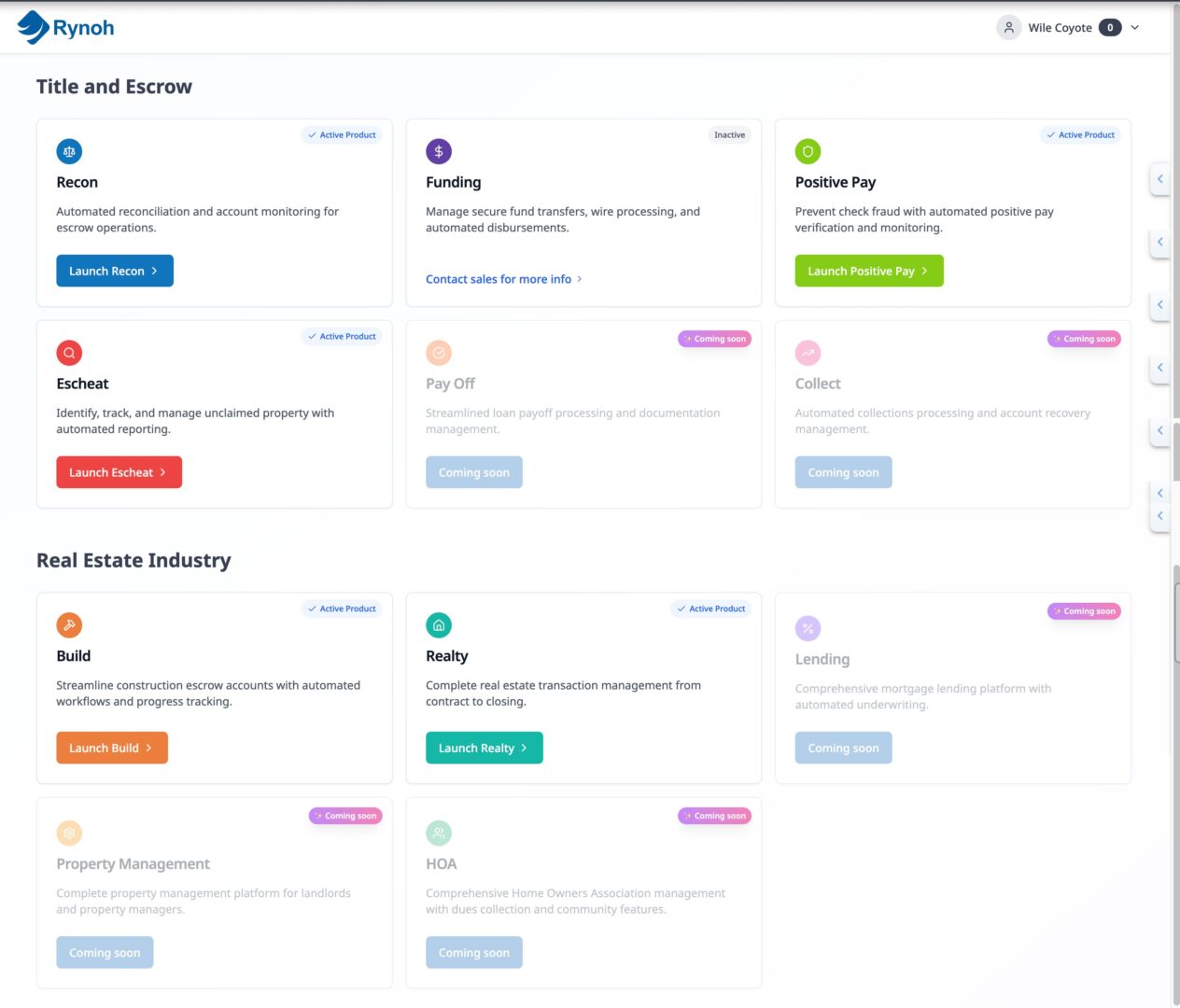

Informative Login Screen & New Product Hub

Launch Date: October 2025

Product Overview

Rynoh is rolling out a redesigned login experience that keeps you instantly connected to what’s new across the platform. The updated login screen features a modern look and integrated callouts that highlight product launches, feature enhancements, training resources, and key company updates—all in one convenient place.

We’re also introducing an enhanced post-login product hub, designed to make navigation clearer and more intuitive. With this new layout, you can easily move between tools, discover new features, and quickly access the resources that matter most to your workflow.

From the moment you sign in, you’ll have quick, clear visibility into the latest updates and what’s coming next—giving you a seamless path to the full Rynoh suite and the tools you need to make the most of every innovation.

Key Benefits

-

Stay Informed Instantly: See the latest product announcements, feature upgrades, and industry insights right from your login screen.

-

Streamlined Experience: A refreshed design improves usability, creating a smoother transition into your Rynoh dashboard.

-

Proactive Engagement: No need to search for updates—key highlights and resources are available the moment you log in.

-

Consistent Awareness: Ensure your team never misses important compliance updates, training opportunities, or security enhancements.

- Simplified Navigation: The new product landing page provides a central hub for all Rynoh products, helping you quickly find and access what you need.

How to Access

The updated login screen will be automatically available to all Rynoh users beginning October 2025. No action is required—simply log in as usual to experience the new design and callout features.

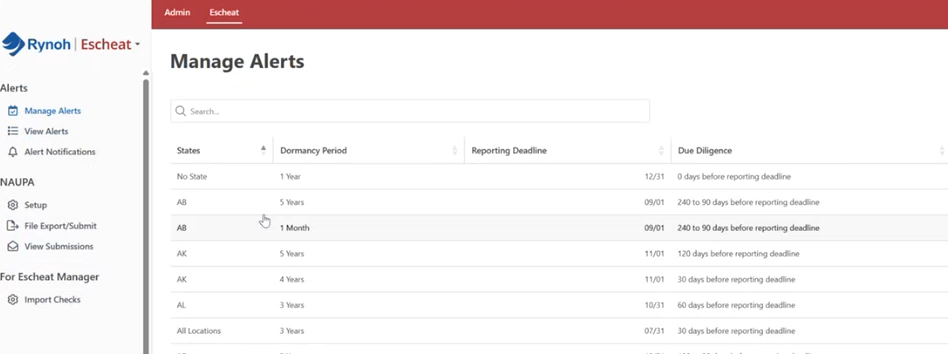

RynohEscheat Enhancements

Launch Date: October 2025

Product Overview

Managing unclaimed property and escheatment is a complex, time-sensitive responsibility. To help simplify the process and reduce risk, Rynoh has significantly expanded the functionality of its Escheat module. These new enhancements deliver greater flexibility, improved tracking, and streamlined workflows—ensuring compliance while saving time and effort for your team.

Key Benefits

-

Expanded Check Management: Import checks that are not currently managed within Rynoh, giving you the ability to incorporate them into your escheatment process, including NAUPA-compliant filings.

-

Advanced Search Tools: Benefit from enhanced search capabilities, including the ability to search for voided checks, and maintain your search parameters throughout your session for improved efficiency.

-

Smarter Due Diligence: All due diligence letters are now saved upon generation, reducing redundant work and ensuring proper record-keeping.

-

Visual Alerts: Attach images to alerts for greater clarity and context, making issue resolution faster and more accurate.

How to Access

These enhancements are available directly within the existing RynohEscheat module. Simply log in to access the new features—no additional setup is required.

Escheat Pro Services

Launch Date: October 2025

Product Overview

Many of our clients have shared that, even with the convenience of the RynohEscheat module, they would prefer to fully outsource the escheatment process to compliance experts. With RynohEscheat Pro Service, that’s exactly what we deliver.

Escheat Pro takes the complexity and risk out of escheatment by managing the entire process on your behalf—from start to finish. Our dedicated compliance team ensures accuracy and adherence to state regulations by reviewing prior payee contact efforts, distributing final due diligence letters, processing payee responses, and filing state escheatment reports. The result is seamless, stress-free escheat reporting with compliance and minimal effort required from your team.

Key Benefits

With RynohEscheat Pro, you can rely on our experts to handle the escheatment process end-to-end. Recent enhancements include:

-

QR Codes on Due Diligence Letters: Provides payees with a quick, digital way to respond in real time via a secure micro landing page.

-

Automated Letter Delivery: Outsource due diligence letter distribution and eliminate manual mailing tasks.

-

Peace of Mind Through Expertise: Gain confidence knowing compliance specialists are overseeing every step, reducing errors and ensuring timely filing.

How to Access

To learn more or enroll in RynohEscheat Pro Service, please contact our team

Multi-Factor Authentication (MFA)

Launch Date: October 2025

Product Overview

Rynoh has strengthened its security framework with the integration of full Multi-Factor Authentication (MFA). MFA adds an additional layer of protection to your login process, ensuring that only authorized users can access your Rynoh account. By combining something you know (your password) with something you have (such as a mobile device or authentication app), MFA significantly reduces the risk of unauthorized access and fraud.

Key Benefits

-

Stronger Account Protection: Safeguard sensitive financial data and client information against compromised credentials.

-

Reduced Fraud Risk: Minimize exposure to account takeover attempts and phishing attacks.

-

Regulatory & Industry Alignment: Meet growing industry and compliance standards for financial data security.

-

Seamless User Experience: Flexible authentication options (e.g., SMS, authenticator app, or email) ensure security without sacrificing convenience.

-

Peace of Mind: Confidence that your Rynoh account is protected by the latest security standards.

How to Access

MFA will be automatically enabled for all users beginning October 2025. Upon logging in after the release, you’ll be prompted to set up your authentication method. Once configured, MFA will be required each time you sign in to Rynoh, ensuring ongoing account security.

Rewind & Refresh With Software Upgrade V3.1 Highlights

Launch Date: July 2025

Enterprise Reporting Capabilities

For our enterprise clients managing dozens—or even hundreds—of bank accounts, we’ve introduced powerful new features tailored to your needs. You can now assign specific reconciliation personnel to individual bank accounts, providing a clear view of account statuses by reconciler.

We’ve also enhanced reporting capabilities with tools like the High Balances Report, Book Balances, Debit Files Report, and Debit File History. Each report can be customized to focus on a specific reconciler’s portfolio, giving you precise insights into account management.

These enterprise-grade reports put you firmly in control, enabling you to generate targeted, actionable insights for managing large account portfolios with ease and efficiency.

New Software Video Tutorials & Client Resource Center

Team Rynoh is excited to introduce new training resources and online materials to help users confidently navigate their software bundle. These tools include interactive videos and live webinars, making it easier than ever to explore and navigate the updated interface and software modules and features. With the improved reporting dashboard, businesses can now track financial transactions in real time and quickly gain valuable insights.