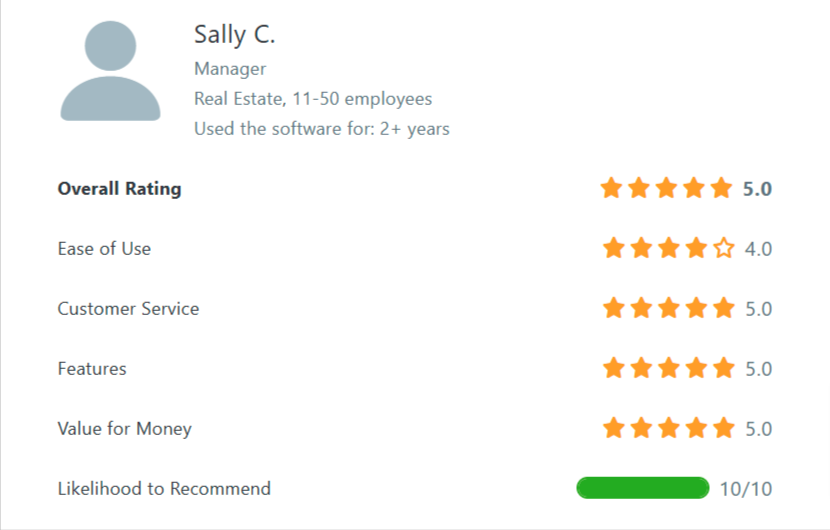

Rynoh Reviews 4.8/5

Capterra Ratings

Our clients rave about how our software has revolutionized their escrow accounting practices. They no longer have to manually reconcile transactions or worry about errors in their calculations. Our advanced reporting features provide a comprehensive overview of all escrow activities, making it easy for businesses to track and monitor their funds. hashtag#CapterraReviews

Background

Sally C., a manager in a real estate firm, oversees financial operations which includes monitoring transactions and managing risks. With the firm handling large amounts of money daily, staying on top of account activity was critical to avoiding costly mistakes or fraud. RynohLive became a key tool in her operations, providing real-time alerts and daily reporting to ensure financial accuracy and safeguard the firm against significant losses.

Challenges Before Rynoh

- Lack of visibility into account activity left the firm vulnerable to undetected issues like expired stop payments.

- Manual processes struggled to catch human errors in deposits or dates.

- Addressing errors and discrepancies required time-consuming manual reviews.

Solution

RynohLive provided Sally with comprehensive daily reporting and real-time alerts that ensured immediate identification of issues. The platform’s automation flagged discrepancies before they escalated, saving her team both time and potential legal expenses.

Results

RynohLive provided Sally with comprehensive daily reporting and real-time alerts that ensured immediate identification of issues. The platform’s automation flagged discrepancies before they escalated, saving her team both time and potential legal expenses.

Key Features Loved by Sally

- Daily Reporting: Morning reports provided a clear and immediate view of account health, highlighting issues to be addressed.

- Fraud Prevention: Proactive alerts flagged risks like expired stop payments, preventing financial losses.

- Error Detection: Double-checking capabilities quickly identified and flagged human errors.

- Ease of Use: While occasionally requiring adjustments, RynohLive’s features were straightforward and effective.

“The daily reporting when you get in first thing in the AM lets me know IMMEDIATELY if there is an issue that needs to be addressed. It brought to our attention a $220,000 stop payment issue we would have missed without RynohLive. It’s 99.9% human error—not a Rynoh error—and Rynoh helps us catch it every time.”

Conclusion:

For Sally C., RynohLive has proven indispensable in maintaining financial oversight and preventing costly errors. Its daily reporting and error detection capabilities ensure that her firm’s accounts are monitored with precision, protecting the business from potentially devastating losses.

Request a Demo

Turn Your Production Hours Into

Minutes With Automation.

Rynoh is the industry-leading end-to-end account auditing & reconciliation management platform,

designed by a title agent for title agents. Automate the mundane, ease the audit process,

and close out each month with time to spare.

Automated Escrow Reconciliation | Escheatment | Operation Account Management | Account Verifications