RynohVerifi

Account Verification & Fraud Enhancements

Rynoh Verifi is the latest innovation in Rynoh’s all-in-one software bundle, delivering cutting-edge transaction verification solutions to enhance efficiency, accuracy, and user experience across the financial operations spectrum. Purpose-built for organizations that manage escrow, trust, or other high-liability accounts, Verifi offers a seamless, automated approach to transaction oversight, eliminating bottlenecks while strengthening internal controls.

Key Features

Fraud Alerts

Stay ahead of threats with real-time fraud alerts that proactively notify your team of suspicious or unauthorized activity, helping to prevent financial loss before it occurs.

Account Verification

Ensure the integrity of every transaction through automated account verification, reducing the risk of errors and enhancing trust between all parties involved.

Enhanced Security

Protect sensitive financial data with robust security protocols and system safeguards built to meet the highest standards of compliance and risk management.

Product Summary

RynohEscheat

RynohVerifi is a next-generation account validation solution designed to help financial institutions and businesses proactively combat transaction fraud. By delivering real-time verification of user-provided bank account details, RynohVerifi confirms that accounts are active, legitimate, and properly associated with the intended payee—before any funds are moved.

- Admin

Easily search criteria, including:

- Agencies* – Filter transactions by associated agency or partner organization

- Banks – Narrow results by specific financial institutions

- Account Type – Search by escrow, trust, operating, or other account categories

- Funding Status – Identify transactions based on current funding stage

- Funding

Stay on top of every transaction with:

- Integrated Modules:

- Verifi: Ensures account information is accurate and verified before transactions are processed.

- Payments: Facilitates secure, streamlined disbursement of funds through validated channels.

- Real-Time Alert Notifications:

- Verifi Alerts: Instantly notify users of validation issues or mismatches in payee or account data.

- Payment Alerts: Provide updates on payment status, authorization requirements, and processing outcomes.

- Key Data Fields Tracked:

- File # – Unique identifier for each transaction record

- Routing # & Account # – Used for bank-level account validation

- Payee & Amount – Specifies the recipient and the transaction value

- Transaction Type & Date – Categorizes and timestamps each payment

- Verifi Status – Indicates whether the account has been validated successfully

- Authorized – Tracks approval status for disbursement

- Verified On – Shows the date and time of successful account verification

- Account Nickname & Bank Name – Helps identify accounts quickly and accurately

Rynoh Adds More Superpowers to Its All-In-One Software Bundle With Transaction Solutions

Rynoh, a leading provider of financial protection and escrow management software for the real estate industry, is constantly looking for ways to improve its product offerings. In order to provide their customers with the best possible experience, they have recently announced an upgrade to their all-in-one software bundle – SyncOut.

Automated Escrow & Financial Management System

Schedule a Demo

Dashboard Snapshots

Reporting Dashboard

Menu Options

Client R&D Resources

Client Feedback

- Name: Tina W.

- Title: Escrow Officer

- Usage: Used the software for: 2+ years

- Quote: “Best Way to Catch Accounting Errors!”

Our company relies heavily on this software to double check all of our real estate transactions. I had a refinance file that was funding and the bank had made an error when sending me the deposit. They had actually listed it as “debit” instead of “credit”. I was in a hurry and just saw the amount matched and didn’t notice the “()” around it meaning it was a debit and not a credit as intended. RhynoLive caught the error right away and we were able to get it corrected immediately.

Product Specs

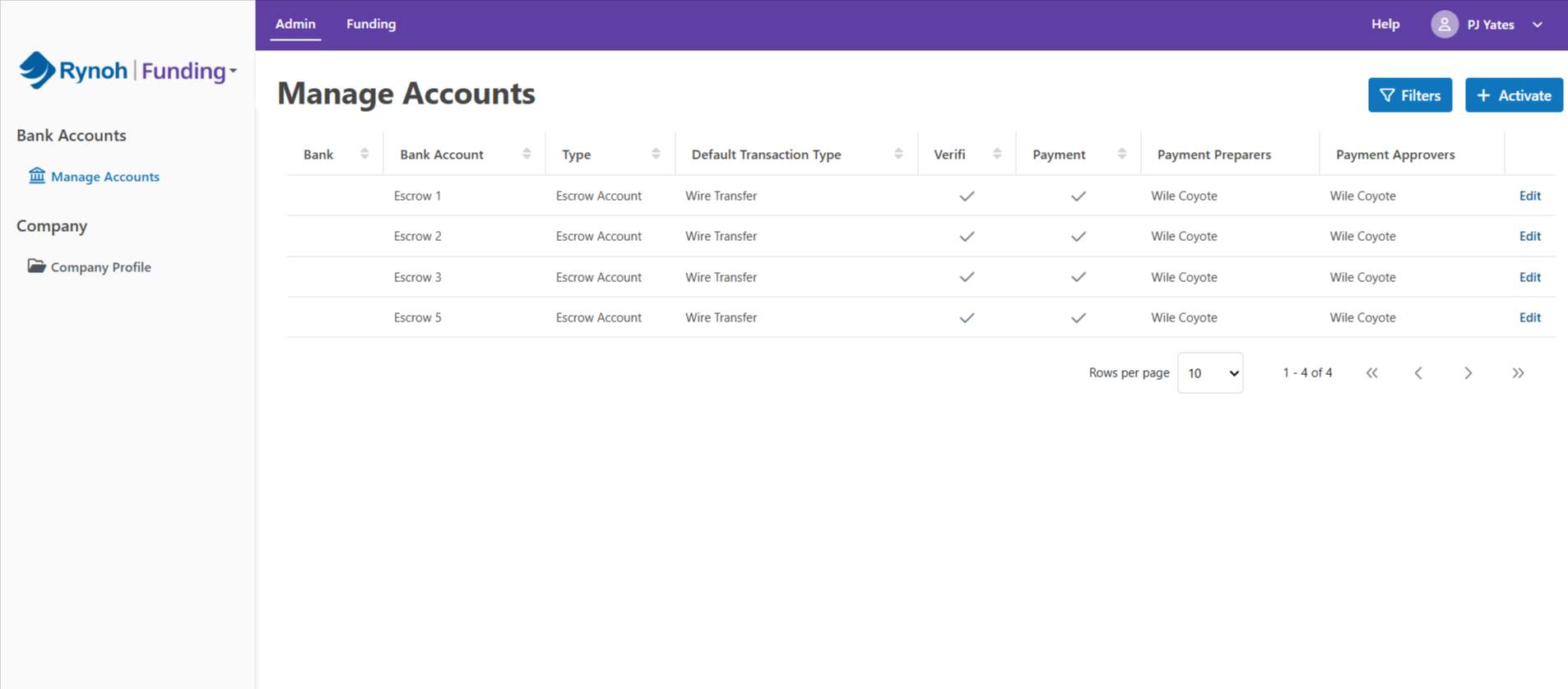

Admin

- Manage Accounts

- Search Criteria

- Agencies

- Banks

- Account Type

- Funding Status

- Search Criteria

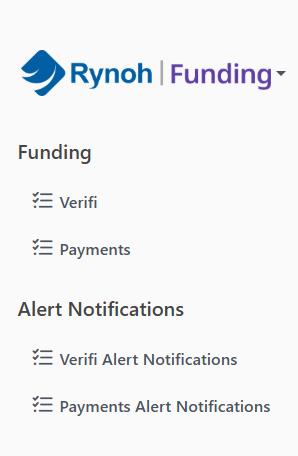

Funding

- Verifi

- Payments

Alert Notifications

- Verifi Alert Notifications

- Payments Alert Notifications